Mortgage calculator no pmi

Use our free mortgage calculator to estimate your monthly mortgage payments. Using our mortgage rate calculator with PMI taxes and insurance.

Pmi Mortgage Insurance Calculator 2022 Casaplorer

The 15-year fixed-rate mortgage is the second most popular home loan choice among Americans with 6 of borrowers choosing a 15-year loan term.

. Across the United States 88 of home buyers finance their purchases with a mortgage. Account for interest rates and break down payments in an easy to use amortization schedule. By entering just a few data points into NerdWallets mortgage income calculator we can help you determine how much income youll need to qualify for your mortgage.

PMI protects the bank or lender in case a homeowner stops paying a mortgage. Here is where you enter the additional costs that are typically billed as part of your monthly mortgage payment. 15-Year Vs 30-Year Mortgage Calculator Mortgage Refinance Calculator Mortgage APR Calculator.

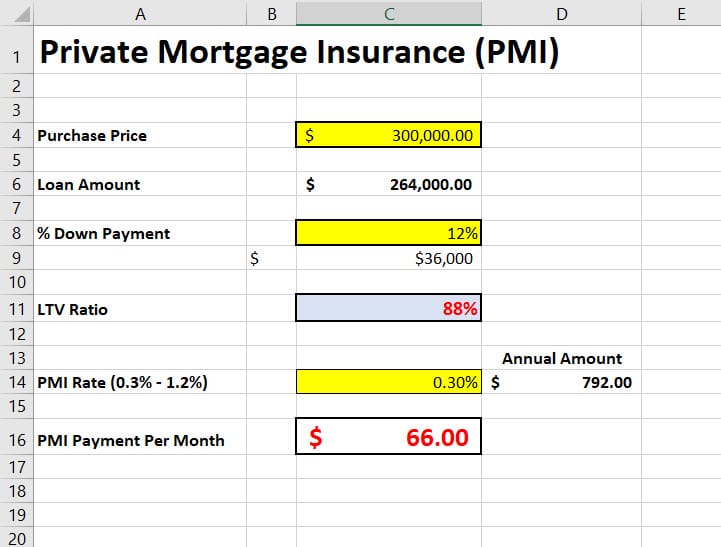

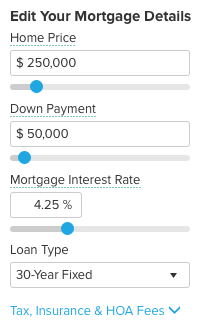

You can adjust the home price down payment and mortgage terms to see how your monthly payment will change. Low minimum credit score requirements. The cost of PMI varies greatly depending on the provider and the cost of your home.

Down payment 5 down 15 down 20 down. Avoid private mortgage insurance. Your homeowners insurance premium is divided by 12 to calculate this monthly amount.

Lets take a moment to go through the various moving parts of the home loan calculator to get a better. With a 30-year fixed-rate mortgage you have a lower monthly payment but youll pay more in interest over time. Estimate your payment with our easy-to-use loan calculator.

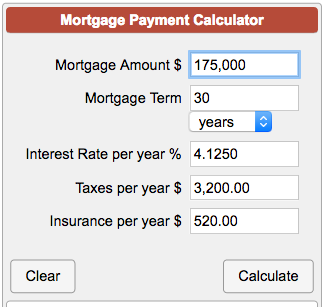

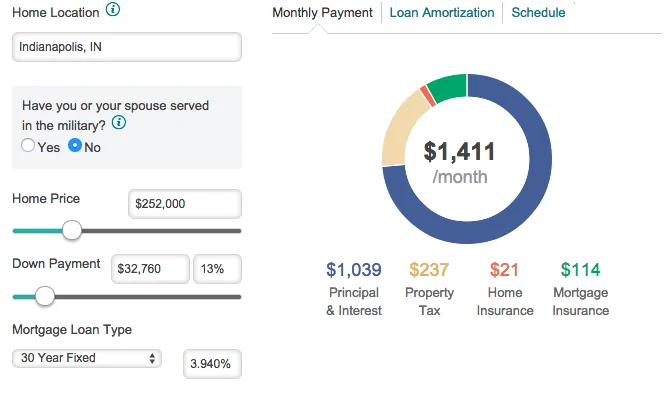

This free mortgage calculator lets you estimate your monthly house payment including principal and interest taxes insurance and PMI. Use Zillows home loan calculator to quickly estimate your total mortgage payment including principal and interest plus estimates for PMI property taxes home insurance and HOA fees. For most conventional loans youre required to pay for private mortgage insurance PMI along with your monthly mortgage payment until your loan-to-value LTV reaches 78-80.

See how changes affect your monthly payment. Of those people who finance a purchase nearly 90 of them opt for a 30-year fixed rate loan. If youve purchased a home with less than 20 down your lender probably required you to purchase.

The loan program you choose can affect the interest rate and total monthly payment amount. Principal Interest Property taxes. The calculator divides your annual property taxes by 12 to calculate this monthly amount.

Mortgage payment The monthly mortgage payment is calculated based on the inputs you provided. The most common loan terms are 30-year fixed-rate mortgages and 15-year fixed-rate mortgagesDepending on your financial situation one term may be better for you than the other. Then get pre-qualified to buy by a local lender.

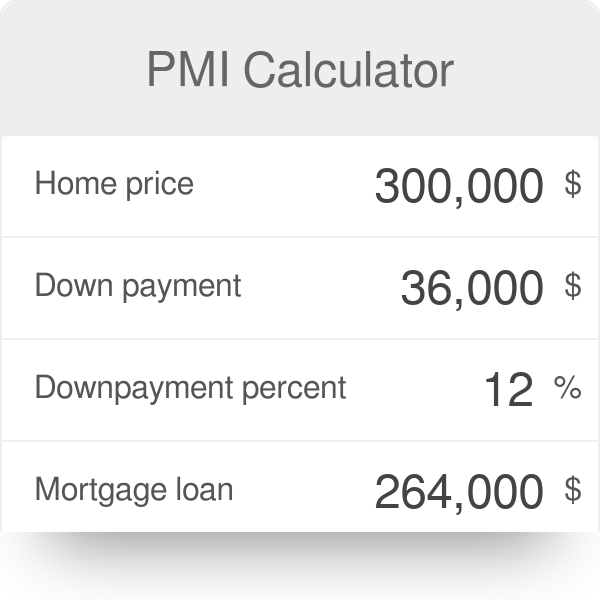

That moment can be calculated with loan to value ratio that shows the exact date when the loans principal balance fall to 80 of the homes purchase price. A general affordability rule as outlined by the Canada Mortgage and Housing Corporation is that your monthly housing costs should not exceed 32 of. Use this free California Mortgage Calculator to estimate your monthly payment including taxes homeowner insurance principal and interest.

The mortgage amount rate type fixed or variable term amortization period and payment frequency. Mortgage insuranceIf your down payment is less than 20 of the cost of your house many lenders will require you to pay an additional fee called. Enter the price of a home and down payment amount to calculate your estimated mortgage payment with an itemized breakdown and schedule.

Use SmartAssets mortgage calculator above to estimate your monthly mortgage payment including your loans principal interest taxes homeowners insurance and private mortgage insurance PMI. The free mortgage calculator is a versatile tool as useful to an individual casually researching properties as it is to someone on the cusp of making a purchase. The VA loan calculator provides 30-year fixed 15-year fixed and 5-year ARM loan programs.

Use the worksheet indicated to enter estimates for those figures. To avoid paying private mortgage insurance PMI on a conventional loan lenders expect a down payment of at least 20. If you pay less than 20 lenders will expect you to pay PMI as.

If your initial downpayment is below 20 you can request PMI be removed when the loan-to-value LTV gets to 80. For example a 30-year fixed mortgage will have a lower monthly payment than a 15-year fixed but will require you to pay more interest over the life of the loan. Mortgage insurance may sound similar to Private Mortgage Insurance PMI but theyre entirely different.

No PMI loan Medical Professional Loan. Mortgage protection insurance vs. If you make less than a 20 down payment the estimated monthly PMI charge displays ehre.

Property taxes homeowners insurance homeowners association fees or dues and private mortgage insurance PMI or FHA mortgage insurance if applicable. Private mortgage insurance PMI. PMI protects the lender in case you default on the loan.

Private mortgage insurance PMI is often required for conventional mortgages with less than a 20 down payment. The HOA fee is included here if applicable. When you put at least 20 down on a conventional loan or 20 home equity on a refinance you can avoid paying monthly private mortgage insurance premiums PMI.

According to the Freddie Mac mortgage insurance calculator and the Bankrate mortgage calculator. Unless you come up with a 20 percent down payment or get a second mortgage loan you will likely have to pay for private mortgage insurance. The charge for PMI depends on a variety of factors including the size of your down payment but it can cost between 025 to 2 of the original loan principal per year.

PMI on conventional mortgages is automatically canceled at 78 LTV. Learn how to use our mortgage calculator to determine your monthly mortgage payments including PMI taxes insurance down payment interest rate and more. Our mortgage payment calculator estimates your total monthly mortgage payment including.

Learn how PMI is used and how to avoid paying for it. With a help of Calculator a borrower can determinate the moment when paying for private mortgage insurance is no longer necessary due to the amount of money that was already paid.

5 Alternative Ways To Use A Mortgage Calculator Zillow

Free Mortgage Calculator Free Financial Tools Transunion

Mortgage Calculator With Taxes And Pmi Hotsell 54 Off Sportsregras Com

Usda Loan Payment Calculator Calculate Loan Guarantee Eligibility Closing Costs How Much You Can Afford To Borrow

Mortgage Calculator With Pmi Mortgage Calculator

What Is Pmi Understanding Private Mortgage Insurance

Pmi Calculator Mortgage Insurance Calculator

Mortgage Insurance Calculator Clearance 56 Off Www Ingeniovirtual Com

5 Alternative Ways To Use A Mortgage Calculator Zillow

Downloadable Free Mortgage Calculator Tool

5 Best Mortgage Calculators How Much House Can You Afford

:max_bytes(150000):strip_icc()/HowtoOutsmartPrivateMortgageInsurance6-afd72524ae714573bab8c3e5e32f895e.png)

How To Outsmart Private Mortgage Insurance

Mortgage Calculator With Pmi Mortgage Calculator

Mortgage Calculator With Taxes Insurance And Pmi Hotsell 55 Off Www Ingeniovirtual Com

Private Mortgage Insurance Removal Calculator Your Home Sold Guaranteed Realty Services

How To Avoid Pmi Know Your Options U S Mortgage Calculator

Mortgage Calculator With Taxes Insurance And Pmi Hotsell 55 Off Www Ingeniovirtual Com